Service Provider Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each workers reviewer at Service Provider Maverick is a subject matter skilled with expertise researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by one other subject material skilled on workers earlier than publication. Merchant Maverick’s rankings aren’t influenced by affiliate partnerships. Now that you realize https://www.quickbooks-payroll.org/ what QuickBooks Payroll is able to, you can make an knowledgeable decision if this software is best for you.

Choosing between Intuit Enterprise Suite and QuickBooks Online is dependent upon the dimensions and complexity of your business. Intuit Enterprise Suite is finest fitted to massive corporations that require advanced tools, detailed stories, and multi-entity management capabilities. It helps multi-entity consolidation, automates income recognition, offers detailed reporting with up to 20 dimensions, and offers AI-driven forecasting.

Automatic Tax Filing, Guaranteed Accurate†

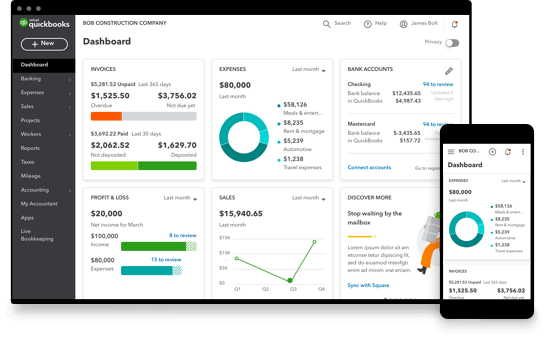

Manage payroll from your office desktop, or take payroll on the street with the QuickBooks cellular app. On the cash-flow entrance, Platinum provides you custom approvals for bills and purchase orders, so nothing slips via the cracks. Built-in safeguards flag anything suspicious, including an additional layer of protection against fraud. Put merely, Platinum keeps inventory moving, prices correct, and funds safe, so you can give consideration to growing your small business. Whether Or Not you’re a small enterprise owner upgrading from QuickBooks On-line or a longtime agency re-evaluating your software costs, this 2025 pricing information provides you the clear numbers. Yes, for a clear enterprise-grade integration, a Payroll Clearing Account a bank or ‘Other Current Liability’ account is essential.

What Are The Different Sorts Of Payroll Services Out There To Us?

Sure, the system routinely calculates, fills out, and permits e-filing of federal and state payroll tax types instantly from QuickBooks. QuickBooks Enterprise Primary Payroll is the entry-level payroll option obtainable within QuickBooks Desktop. It’s designed for companies that want simple payroll processing without superior compliance features. Accounting software isn’t nearly balancing books; it also performs a key position in managing payroll. With QuickBooks Enhanced Payroll, you can streamline the whole process of paying workers and handling tax-related duties immediately within QuickBooks Desktop. All of the QuickBooks Online Payroll pricing plans embody full-service payroll.

Many corporations want these forms of systems which are directly connected to computers somewhat than web-based systems. In relation to the software program, needs Intuit’s QuickBooks has a desktop version for the accounting and payroll options called QuickBooks Desktop Payroll. You also can quickbooks enterprise payroll host your QuickBooks Desktop Enterprise model within the cloud, enabling safe distant entry and a seamless work experience from wherever. QuickBooks On-line is better for small and mid-sized businesses that need easy setup, mobile access, and decrease upfront costs. Evaluate your progress plans, price range, and operational needs to find out which platform provides the optimal stability of features and value for your corporation.

QuickBooks Enterprise Payroll permits you to configure deductions as both pre-tax or post-tax during the setup process. This ensures right tax remedy and correct reporting on forms just like the W-2. If relevant, define whether or not an item is pre-tax or post-tax during setup. This affects how it appears on tax types like the W-2 and how it’s reported to the IRS. You can use the EZ Setup Wizard within QuickBooks for a guided course of, which is in a position to make it simpler to configure deductions and advantages without deep payroll experience. Understanding how advantages and deductions match into your payroll system is vital to ensuring accurate reporting and compliance.

- The per-employee charge shall be billed monthly, primarily based on the number of distinctive employees paid.

- Publicly funded federal initiatives sometimes require employers to pay staff prevailing wages (also often known as Davis-Bacon wages).

- Whichever method you select, make sure funds are timely and correct to keep your employees happy.

- Every new hire must complete this kind, and you’ll need to examine original documents—like a passport or driver’s license—to verify their authenticity.

Quickbooks Enterprise Pricing And Plans

Intuit Enterprise Suite consists of enterprise payroll, onboarding, advantages administration, and HR advisory providers on one platform. Nonetheless, QuickBooks Online Payroll is an add-on that automates payroll and tax submitting and helps advantages such as 401(k) and healthcare, but broader HR capabilities remain limited. QuickBooks Online provides robust options for small and mid-sized businesses, together with computerized bank feeds, AI-powered transaction monitoring, and customizable reports. It handles advanced accounting but doesn’t supply the identical superior monetary planning or multi-entity automation as Intuit Enterprise Suite. Instead of an upfront buy, customers pay a monthly subscription and access the software securely via an internet browser.

Starting August 1, 2025, QuickBooks Enterprise Gold customers who use payroll will start on their subsequent renewal date. The per-employee fee will be billed month-to-month, primarily based on the number of unique employees paid. We hope the above article will be very helpful in tax funds and the filing services however in case you find any issue then you’ll find a way to name us. Our professional team will allow you to in resolving your drawback and in tax funds and submitting additionally. QuickBooks Enterprise Diamond had a quantity of integrated solutions for managing accounting, invoicing, job costings, stock, and employees attendance along with payroll.

See Set up and track payroll expenses by job in QuickBooks Desktop Payroll. You can create hourly payroll gadgets with names like Carpentry, Electrical, or Common Labor for each work classification code. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Make The Most Of import, export, and delete services of Dancing Numbers software program.

Additionally, you will need to run particular payroll reviews that can assist you evaluation your business funds. I’ve come that can help you make certain you’ll able to entry and handle your payroll cloud companies so you can begin working along with your payroll tasks, Shannan. Publicly funded federal tasks typically require employers to pay employees prevailing wages (also known as Davis-Bacon wages). In QuickBooks Desktop Payroll, you can arrange prevailing wages and generate licensed payroll stories.

As a top-tier accounting software program, QuickBooks has lengthy helped small and medium-sized companies streamline their monetary management. QuickBooks Enterprise is the most refined QuickBooks product, serving as an end-to-end software program answer. It combines inventory management, payroll and sales monitoring as a half of its complete suite of features. In this article, we’ll examine the out there QuickBooks Enterprise pricing plans that will assist you choose the best match for your small business. In simply 30 days, you’ll have the ability to experience improved efficiency in working payroll, saving valuable time whereas sustaining accuracy.

Add a Comment